It's the proverbial third rail of politics: raising the gas tax.

But that may be changing. Given punishing commutes and congestion, attitudes towards an increase in the gas tax and other charges on motorists are softening, according to a survey study done by the Mineta Transportation Institute at San Jose State University. The nationally conducted survey included 2,723 respondents.

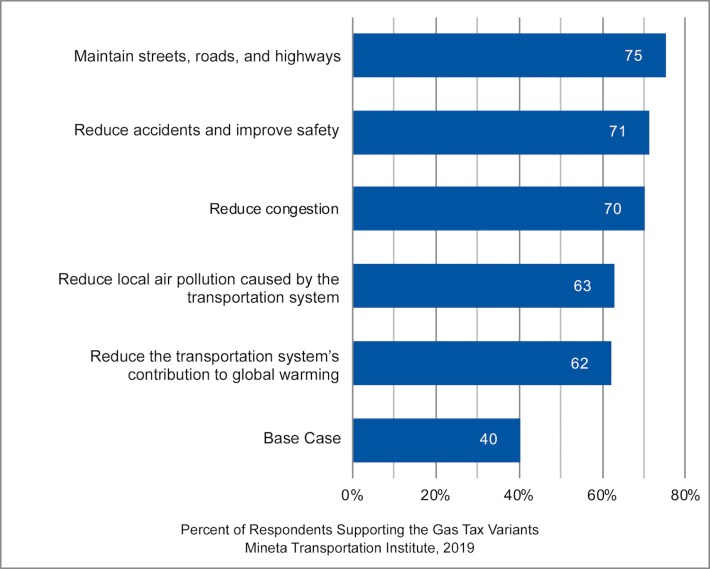

“Support for raising the gas tax is largely dependent on how the revenue will be spent,” says Dr. Asha Weinstein Agrawal, one of the study’s authors and Director of the Mineta Transportation Institute's National Transportation Finance Center. “Seventy-five percent of respondents supported a 10 cent increase in the gas tax if the revenue raised is dedicated to maintenance projects, but only 40 percent support the same increase if the money is used more generally to maintain and improve the transportation system.”

More results from the study, on reasons people would support an increased gas tax:

The extent to which this could be used to help fund transit projects remains to be seen, but transportation and housing officials at this morning's Mineta Transportation Institute Summit in downtown San Francisco, where the results were announced, were hopeful. Also from the study:

- A large majority of survey respondents value transportation improvements across transportation modes, including spending gas tax revenue for road and public-transit-related projects.

- People do not have an accurate understanding of how much they pay in federal gas taxes. For example, 19 percent of respondents thought the federal gas tax rate is at least 76¢ per gallon, far higher than the current rate of 18.4¢ per gallon.

- People would prefer to pay a mileage fee each time they buy fuel or charge an electric vehicle, rather than being billed monthly or annually.

- People hold nuanced views on mileage fees with respect to equity and privacy.

- Linking transportation taxes to environmental objectives can increase support.

The findings may also have implications for local attempts to get motorists to pay the true costs of driving by, for example, using congestion pricing to alleviate traffic and increase funding for mass transit.