BART Passed Over on Federal Loan for Airport Connector This Fiscal Year

1:04 PM PST on November 11, 2010

As part of the complicated funding swaps BART staff arranged with regional and state transportation planners to proceed with the Oakland Airport Connector following the loss of $70 million in federal stimulus dollars due to civil rights deficiencies, the transit operator was hoping to get a federal loan with a low interest rate and a favorable interest payment schedule.

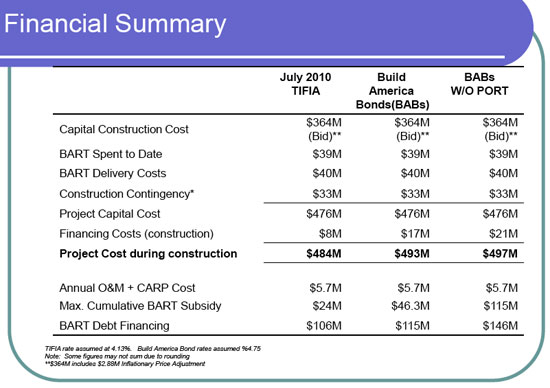

Unfortunately for OAC proponents, as reported recently in Project Finance Magazine (subscription needed), the US DOT announced its Transportation Infrastructure Finance and Innovation Act (TIFIA) loans for FY 2010-11 and the OAC was not among the projects selected. BART had applied for $105 million from the feds for the $484 million project.

Because BART has enough cash on hand to proceed with preparations for construction and actual groundbreaking in early 2011 (versus the ceremonial event held last month) and because TIFIA loans can be applied for continuously, the agency was not particularly concerned with the news.

"Quite frankly we don't need the money right now," said BART spokesperson Linton Johnson, who explained that in BART's experience TIFIA loans are prioritized for projects that urgently need them. He also pointed to Federal Transit Administrator (FTA) Peter Rogoff's assurances that BART would get a $25 million New Starts grant when the feds accept its revised civil rights compliance . "This shouldn't be an indication that we're not eligible for it or that something is wrong."

OAC opponents offered a different analysis of the federal action and said this narrowed BART's options for financing and ultimately would raise the debt obligation for the project by millions of dollars. Referring to BART's own analysis, TransForm's John Knox White indicated that if BART cannot secure a TIFIA loan, in the best case scenario with Build America Bonds they would have to subsidize the OAC with $46.3 million from the core system (versus $24 million) and would have to pay $115 million in debt financing (versus $106 million).

"The TIFIA decision is yet one more example of how BART's likely financial scenario in its presentation was overly rosy," said Knox White, who also noted the possibility that Build America Bonds will not be re-authorized and BART could have to go out and find loans with even worse interest and debt scenarios. "That's tens of millions of dollars in debt the core system will have to cover."

Because the BART board removed any preconditions that would have compelled staff to bring a revised funding plan before them should they not secure TIFIA, BABs or other funding (such as the Port of Oakland's passenger surcharge approval from the Federal Aviation Administration), there will not likely be further debate about the financial scenario.

Johnson expressed optimism, saying he believed BART would be well-positioned for TIFIA loans in FY 2011. "There is a pool of money and it gets replenished. We'd love to have it in hand to make us feel good," he said, but noted, "we're not at the urgent stage yet."

Stay in touch

Sign up for our free newsletter

More from Streetsblog San Francisco

Commentary: Make Bay Area Transit Seamless as Condition of New Funding

SFMTA Starts West Portal Outreach

Agency presents plans to block traffic from crossing in front of the train station