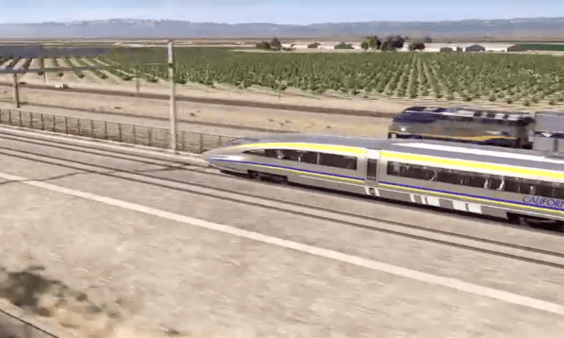

A map of the companies involved in the supply chain for U.S. transit buses. (Image: EDF)

A map of the companies involved in the supply chain for U.S. transit buses. (Image: EDF)When Vice President Joe Biden visited

Minnesota's New Flyer bus company to tout the economic stimulus law's

$8.4 billion investment in transit, hopes were high for a boom in

cleaner-burning vehicle production -- which made for some bad press when the nationwide transit funding crunch forced New Flyer to lay off 13 percent of its workers.

But

the recession hasn't dampened the economic potential of hybrid bus

production, as the Environmental Defense Fund (EDF) laid out today in a

new report [PDF]

on the industry. In fact, EDF found, transit bus companies share enough

skills and regional foothold with the auto industry -- the map of bus

makers pictured above could be mistaken for a map of automakers -- to

pave the way for fuel-efficiency advances that would ultimately benefit

all vehicles.

After noting that 32 percent of American transit buses do not rely on gas or diesel to run, today's report continues:

Thebus industry serves as an important entry point for advanced vehicletechnologies, especially in new vehicles that require refuelinginfrastructure and other major changes. For instance, since transitagencies have a well-defined base of centrally managed fleets, they areideal for testing and proving plug-in hybrid and all-electric buses —thus leading the way for the passenger car industry.

While U.S. bus companies are well-positioned proving grounds for

cleaner-burning vehicles, their export potential remains low, according

to the EDF report. That's largely because the largest market for

transit buses is China, where demand is expected to grow by 12 percent

annually over the next decade -- double the projected growth rate in

North America -- and where production standards are markedly lower.

"Emerging

countries’ lower technology levels and standards appear to prevent them

from competing in industrial country bus markets, while industrial

countries’ higher production costs and standards appear to prevent them

from competing in emerging country markets," EDF concluded.

Even so, there is a limited opening for bus supply companies to prosper on a global level. About 12,000 of Indianapolis-based Allison Transmission's 14,000 sales have come in China, and Firestone, which produces bus suspensions, has operations in China and India.

Yet

it's the domestic employment and growth potential of bus makers that is

the ultimate subject of EDF's report, which notes that such potential

"is heavily dependent on the availability of public funding for bus

transit." And at a time when labor unions are pushing the job-creating power

of federal funding for operating costs, EDF's findings represent the

other side of the coin -- the role transit money plays in sustaining

manufacturing jobs many miles away from the cities where local networks

operate.